The crypto market shows signs of stabilisation, after the hype earlier this year, when over $24 billion worth of Bitcoin was sold by long-term investors to new speculators. A recent report by Chainalysis has found that the cryptocurrency holdings have not changed over the summer, with investors and speculators maintaining their positions.

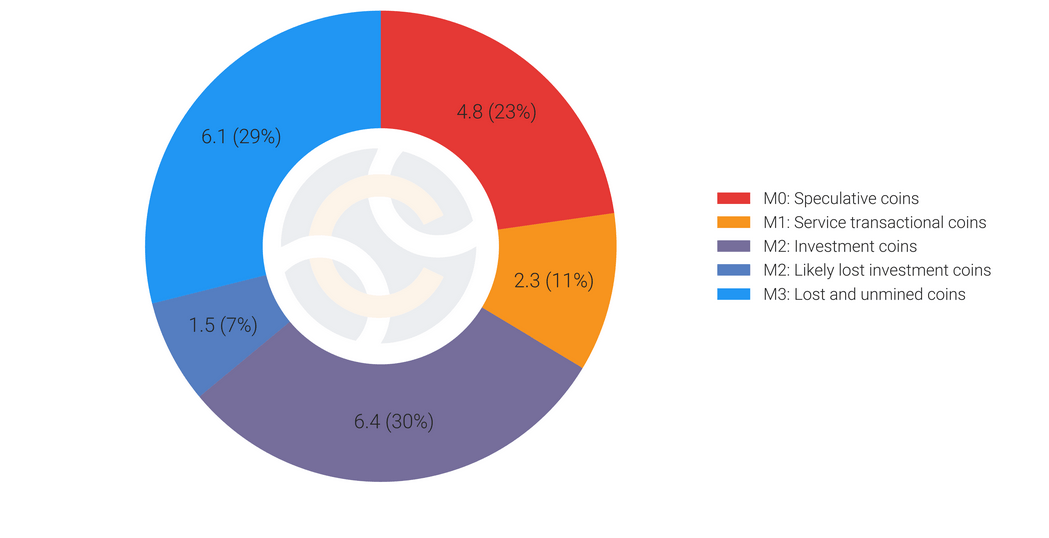

Chainalysis analyses Bitcoin blockchain activity in order to understand different types of users and define the money supply according to monetary aggregates. As far as Bitcoin goes, it can be categorised from the most liquid monetary aggregate or M0 (coins used for speculation and transactions), to less liquid (coins held by both new investors and long-term HODLers, for investment), and the least liquid or M3 (coins that are yet to be mined or are lost).

According to Chainalysis, the crypto market is defined mostly by the long-term investors, who have been holding around 30% of Bitcoin, while speculators present a sizeable group, with 23% of the total Bitcoin supply.

Most of these speculators entered the market in the period December 2017 – April 2018, when Bitcoin reached a record high of almost US$20,000 and investors liquidated their holdings.

New Data Shows Market Stability in Each of the Monetary Aggregates

However, after the active movements in the crypto market during Q1, things have settled down. New data collected over the summer by Chainalysis indicates that both investors and speculators held their positions, with no major changes in holdings or market positions of each group.

From May to August, the Bitcoin holdings of the two major groups were:

- 30% for investors;

- 22% for speculators.

The authors of the report believe that “this is a sign of a market less sensitive to hype, where each news item does not have the ability to significantly push bitcoin prices up or down. Instead, the market seems to have recalibrated after the entry of so many new market participants with different beliefs and expectations than those who held bitcoin prior to 2017”.

Since there are no significant changes to the positions of either long-term investors or new speculators, the report suggests that the crypto market could make a major move only in the case of some fundamental developments, such as new use cases, technology improvements or important regulatory updates.

Additionally, Chainalysis notes that the continued presence of both long-term investors and new speculators demonstrates that Bitcoin has been maintaining the growth in its user base since the end of last year, stating that “the first challenge of adoption —getting cryptocurrency into people’s hands— has been overcome, but we are now waiting to see what the next stage of adoption looks like”.