What is the Bitcoin white paper and what is it all about?

Some say it’s a “must read” for getting into the crypto space, however it can be difficult to decipher if you’re new to the industry.

In this article, we unpack the key points of the white paper and get you ready for your journey into the crypto world.

The Backstory

Released on October 31st 2008, Satoshi Nakamoto’s white paper marks the birth of Bitcoin as we know it today. Authored under the pseudonym Satoshi Nakamoto, the creator’s identity is unknown to this day. Despite this, the Bitcoin white paper (pdf here) is a revolutionary document that marks the beginning of the age of digital currency.

The Problem with Electronic Cash

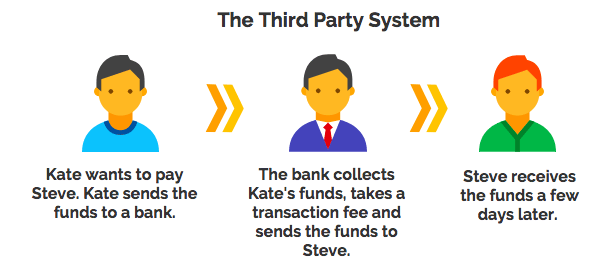

The white paper begins by addressing the key issues associated with electronic payments. Satoshi suggests these issues stem from relying on a “third-party”. This could be a bank or a service like Paypal, which is usually involved when you want to process a transaction. These systems require great trust from consumers, who give responsibility to this third party.

The Proposed Solution

So what’s the alternative?

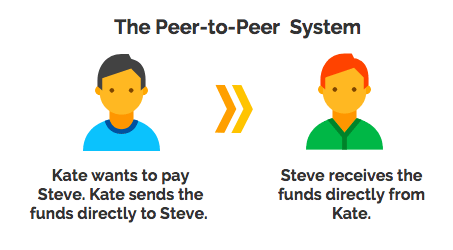

At its core, Satoshi’s solution is to completely remove the centralized third-party system. Put simply, this would allow the consumer to be their own bank and not have to go through a company to complete a transaction.

The paper proposes a system based on “cryptographic proof”. This lays the foundation for the technology we know as blockchain today.

What does this solution involve?

There are many components involved in Satoshi’s solution. This section will only cover the essential parts.

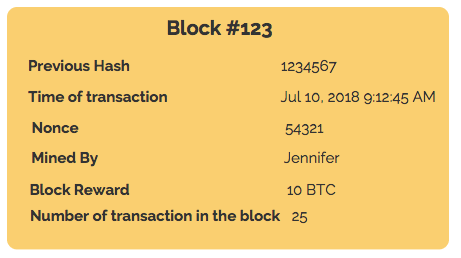

The Timestamp

The timestamp provides proof of a transaction’s existence by recording the exact time and date that each transaction is processed. Just like a transaction history in your bank account, a timestamp records all necessary information from the transaction.

However, unlike a bank or third party, each transaction is publicly announced for everyone to see. This creates a chronological chain of transactions, which are stored in blocks.

In the process, the blockchain is created.

Hashing

Within the blockchain is a small yet highly significant process known as hashing. This involves taking an input of numbers or letters and processing this into a smaller, fixed and encrypted output called a hash.

Like what an acronym does to a long sequence of words, a hash provides an efficient way to recognize and organize large pieces of data on the blockchain.

The process is comparable to how TinyUrl.com condenses a long URL. This program takes a long URL address and makes it shorter and more manageable.

A hash is absolutely essential to upholding the security of the blockchain. Since each block contains a different hash, it is immediately clear if an individual attempted to change a transaction on a previous block. Others on the network would be alerted to an attempted hash change, which could indicate an attacker in the system.

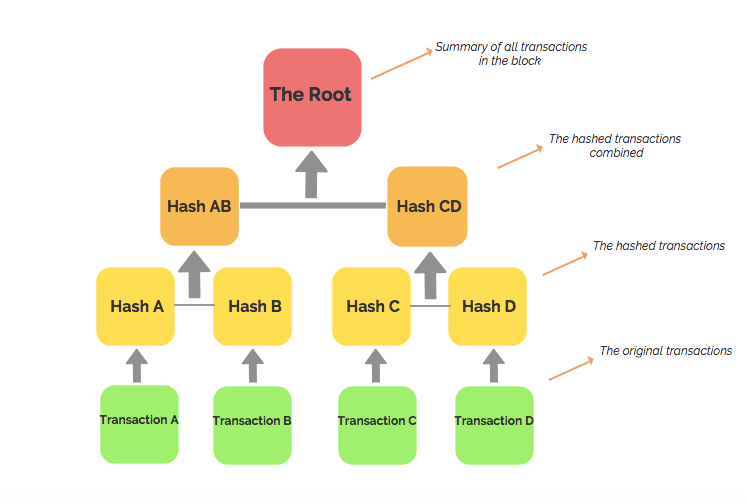

Merkle trees

A Merkle Tree is commonly used in computer science as a way to conserve disk space. In the blockchain, it condenses the hashes within each block and provides a summary of each block without downloading the entire data set.

Think of it like a blurb on a book cover – providing an overview of what’s inside without having to read the entire book. With an average of 500 transactions within each block, the tree structure preserves the disk space of miners validating transactions.

Digital Signatures

Without a bank or third party, the blockchain must verify transactions internally. This is where digital signatures come in.

Digital signatures involve an encrypted code or ‘key’ that is attached to each transaction in the blockchain. This must be verified or signed in order for the chain of transactions to be validated. Each key is unique to each individual and is a way to link each transaction to the sender and receiver.

Think of a public key as your email address and a private key as your email password. Anyone can send an email to your public key (email address), but only you can open it using your private key (email password).

Proof of Work

Finally, proof of work is the ultimate defense mechanism of the blockchain. It is an algorithm that allows the network to determine the validity of each transaction. Satoshi designed proof of work to prevent what’s called the “double-spending problem”.

This problem occurs when an individual attempts to spend the same Bitcoin twice, essentially creating counterfeit money. Proof of work ensures this doesn’t happen by requiring the network to complete a computational puzzle before the transaction is processed.

This puzzle takes time and processing power to complete, making it very difficult to alter transactions on the blockchain.

Conclusion

The Bitcoin white paper is a revolutionary document that lays the foundation for the age of digital currency. It addresses the key issues associated with electronic payments and proposes a solution based on cryptographic proof. By understanding the key points of the white paper, you can better appreciate the technology behind Bitcoin and other cryptocurrencies.