Huobi stands accused of colluding with EOS block producers to the detriment of investors after an internal excel document was leaked to the public by an unverified source.

The spreadsheet, allegedly written by Huobi employee FeiFei Shi, is titled Huobi Pool Node Account Data 20180911. It suggests that Huobi is voting for several specific block producers in exchange for EOS tokens.

Moreover, is appears that block producers including Huobi are voting for one another to uphold their prominent roles in the EOS network.

EOS executives released a statement on Medium yesterday to acknowledge the allegations. They announced a plan to use an internal dispute resolution system to resolve the issue:

“Consider that not every allegation is true, and not every allegation is false. What matters is what evidence is found and that a fair, repeatable, documented dispute resolution procedure is followed.”

With this in mind, Bitcoin Australia examines the evidence to see how credible the allegations are.

First, What are Block Producers?

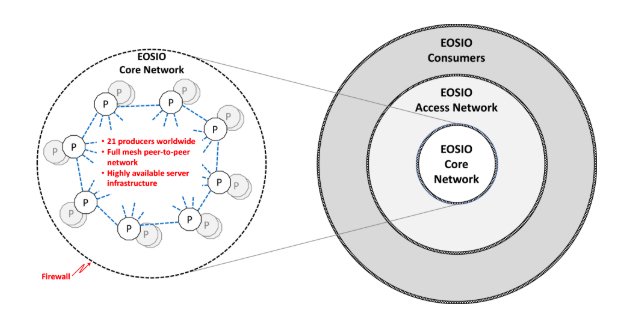

“Block producers in EOS technology are 21 delegates elected by the token holders [who] are actually confirming transactions of the network,” said EOS CEO Brendan Blumer in a promo video.

Block producers, or BPs, are indispensable. Ben Wyatt, an engineer with EOS, called BPs “the central brain of the blockchain.”

“They are custodians of the network,” Mr. Wyatt added. “They will be the first to run a transaction on the network, the first to compute a new value.”

This is mutually beneficial as BPs earn EOS tokens produced by token inflation. While encouraged to use these proceeds to reinvest in the EOS network, they may also stockpile tokens for personal gain.

In short, EOS cannot function without block producers. But according to the leaked spreadsheet, some BPs aren’t playing fair. This puts the entire network at risk.

Examining the Evidence

Screenshots of the spreadsheet released by China-based EOSONE corroborate the accusations.

According to EOSONE the document contains four tables. They summarise the following data: mutual vote exchange, control node voting situation, node income statement, and ticket position and account situation.

Pass over the headings below to see the English translation by Bitcoin Australia of the mutual vote exchange table.

In the spreadsheet above EOSONE highlighted in grey four node names on the list: eospaceieos, cochainworld, eosiosg11111, and cryptokylin1.

These names correspond with legitimate block producer nodes currently operating on the EOS network according to the EOS network monitor.

For instance, block producer eospaceioeos is #18 at the moment. At the time of writing it has over 79 million votes from across the network.

BP cochainworld sits at #19 with 78.5 million votes, while eosiosg11111 comes in 16th with slightly over 81 million. Cryptokylin1 is a backup server as #175 and with a quarter of a million votes.

EOSONE asserts that these four nodes are controlled by Huobi and generated a profit of 1,116 EOS tokens per day between September 5th and September 11th.

Unsubstantiated Claims

In the crypto community, media groups and individuals have widely reported the leak on Twitter, Facebook and Telegram.

Ethereum founder Vitalik Butarin was quick to seize on the news, tweeting that the Huobi collusion allegations are “completely predictable […] but I didn’t expect it to happen so soon.”

With this largely uninformed and unsubstantiated commentary, the information discussed above is difficult to verify and without precedent.

In conclusion, the reality is that we may never know the origins or author of the leaked spreadsheet.

On the other hand, the Huobi debate has raised an important point of contention amongst EOS users. How decentralised should the network be?

Because this is hardly the first time people have expressed fears of centralisation with EOS. And while there are 21 block producer nodes, only 10 hold more than 50% of all EOS tokens.

In an r/eos forum post six months ago, user @stri8ed wrote that “decentralization is a continuum. EOS sacrifices some decentralization for increased throughput. There is no free lunch.”

There may be no free lunch, but how much are users will to pay?