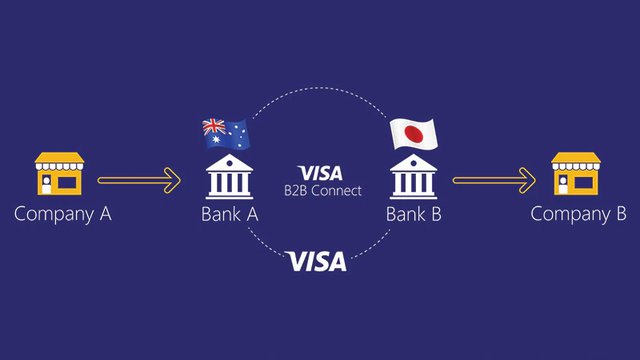

Visa is ready to introduce B2B Connect, the first blockchain-based digital identity system for banking purposes. B2B Connect is undergoing the last finishing touches and will be launched in Q1 of 2019. This digital identity system will be available for legal entities and will speed up cross-border payments.

Blockchain-Based Digital Identity – Faster Transactions and Improved Security

The global head at Visa Business Solutions, Kevin Phalen, believes that B2B Connect will reduce banking fraud. B2B Connect’s digital identity greatly reduces the opportunity for fraud that might otherwise exist with checks, ACH and wire transfers today, while also helping companies remain compliant as part of the regulated financial ecosystem,

he stated in a press release.

Visa’s blockchain-based digital identity system will tokenise sensitive business data. We are talking about the banking details and account numbers of an organisation. These data will receive a unique identifier. Each client will use it to perform transactions on the B2B Connect platform.

Visa believes that B2B Connect will improve information exchange at B2B level in cross-border transactions. According to Visa, B2B Connect embeds safety, security and governance all in one solution

.

B2B Connect, a Short History

Visa announced the first preview of B2B Connect in 2017. During pilot trials, several banks in the US, South Korea, Philippines and Singapore tested bank-to-bank transactions on the platform.

One of the banks included in the test trials is Commerce Bank in the US. The Vice President for commercial payments and products, Chris Wiedenmann said:

In a world of increasing global interconnectedness, the ability to make and receive payments quickly and transparently is critical for companies of all sizes. […] through our powerful relationship with Visa, we are excited to be participating in the Visa B2B Connect pilot.

Advanced Technology for an Innovative Banking Platform

B2B Connect is built on the open source Hyperledger Fabric framework developed by Linux Foundation and the core assets of Visa. This high tech structure will create better processes for financial transactions. The structure will operate on a permission-based and scalable network.

When industry leaders in payments and in financial services technology work together using open source technology, the entire business landscape stands to benefit. BM Blockchain Platform and Hyperledger technology are delivering real business value today and B2B Connect is one of the most powerful examples to date of how blockchain is transforming payments,

said Jason Kelley, General Manager at IBM Blockchain Services.

The First B2B Connect Partner Is Already Known

Although B2B Connect will have its commercial launch next year, it already has an interested partner. Bottomline Technologies, a provider of B2B payments solutions, wants to be the first to integrate it into its framework. This will allow their clients to access the digital identity system without any complex technology updates.

The President and CEO of Bottomline Technology, Rob Eberle, explained his interest in Visa’s new blockchain-based system:

Bottomline serves 1,200 financial institutions globally, and they are always looking to us to provide them with value-add innovations that simplify processes and increase efficiencies. We’re thrilled to work with Visa on this integration to enable our mutual financial institution clients to easily access the B2B Connect platform.

To keep up with the latest crypto and blockchain news and updates, subscribe to our weekly newsletter. If you want to learn more about blockchain, click here.