We’ve known for a while that institutional investors like banks and investment firms were looking at cryptocurrencies. Some people even think that this move may have contributed to pulling cryptocurrencies out of the crypto winter. However, details on what these institutional investors were actually up to were hard to find.

Now, a new report by digital asset investment firm Grayscale sheds light on the matter.

What Is Grayscale?

Grayscale Investment is a company that provides information, technology, and access to investors interested in entering the cryptocurrency space. They last piqued our interest with their paper advocating for Bitcoin to replace gold as the international currency standard. They have since launched a website devoted to the principle of “Drop gold. Go Digital.”

Grayscale works with institutions investing in both a single coin and a diverse portfolio of cryptocurrencies. The second quarter report that Grayscale recently published gives us a mere glimpse into the world of institutional crypto trading.

The Report’s General Findings

Grayscale was founded in 2013, just before Bitcoin’s first big spike and well ahead of the 2018 bull market. However, it was their best quarter since late 2017 and the set-in of the crypto winter. Grayscale’s assets under management tripled this quarter, according to the report. This helps to confirm what we’ve all been hoping – despite recent ups and downs, the crypto winter may be over. The company now holds US$2.7b in assets under management. That’s compared to their record high of US$3.5b in December of 2017.

Another interesting note has to do with Bitcoin and new accounts. Grayscale saw nearly as much new Bitcoin investment in April of this year as in Dec 2017 when Bitcoin was at its highest. April is also the month that the value of Bitcoin rose by almost a thousand dollars. This started the general up-trend that continued until last week. This correlation further suggests that institutional investors may have contributed to the Bitcoin bull market.

The report also details a rise in off-shore accounts compared to US accounts. This could be the result of large-scale crypto adoption in Venezuela and Turkey. However, this is just a guess, as the report did not disclose which countries the accounts were based in.

An Interesting Note on Ethereum

We keep talking about Bitcoin as though Grayscale doesn’t work within other cryptocurrencies. It does, but according to the report, about 75% of their average weekly investments are in Bitcoin. This helps to confirm the understanding that the first cryptocurrency remains the strongest and most popular.

However, investments in altcoins are up to almost a quarter of new investments. This is to be expected as institutional investors are often interested in diverse portfolios to protect their assets. That’s compared to crypto zealots who tend to have one preferred coin regardless of how it performs against other cryptocurrencies.

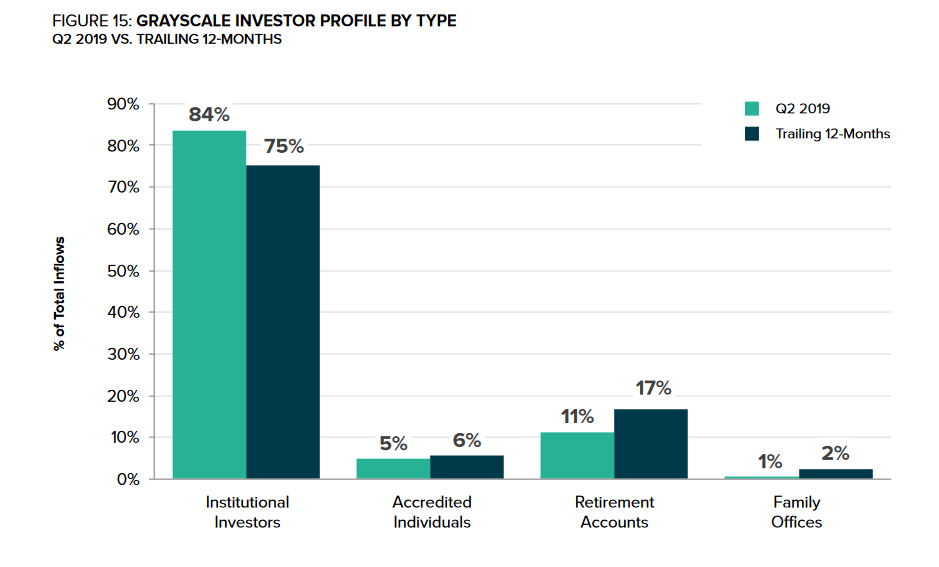

It may take a lot of institutional investors to bump up the sale of altcoins by that much. However, the numbers are there, as 84% of entities working with Grayscale are now institutional investors.

The fact that most new investments through Grayscale is in Bitcoin doesn’t mean that the report had nothing to say about other cryptocurrencies.

In fact, the report had some very interesting news about Ethereum and Ethereum Classic. Both of these altcoins were sources of significant numbers of new investment. The authors of the paper say that this could signal the start of a new “alt investment cycle”. That could bode well for Ethereum advocates.

We’ve been wondering and speculating a lot recently on what institutional investors were up to. This report gives us a more solid understanding of their new role in the crypto world. It will also be interesting to see whether the authors’ predictions regarding altcoins will come to pass in the near future.

Comments(14)

comment goltogel says

January 20, 2024 at 5:22 pmMandatory! Thanks for sharing your knowledge.

comment Xhamster Videos says

January 23, 2024 at 2:59 amyou are in reality a just right webmaster. The site loading velocity is incredible. It seems that you are doing any unique trick. In addition, The contents are masterwork. you have performed a wonderful task on this topic!

comment abonnements iptv smarters pro says

January 25, 2024 at 6:26 amJust wish to say your article is as surprising. The clearness in your post is just cool and i could assume you’re an expert on this subject. Fine with your permission allow me to grab your RSS feed to keep updated with forthcoming post. Thanks a million and please keep up the enjoyable work.

comment Rastrear Teléfono Celular says

January 30, 2024 at 6:20 amCuando sospechamos que nuestra esposa o esposo ha traicionado el matrimonio, pero no hay evidencia directa, o queremos preocuparnos por la seguridad de nuestros hijos, monitorear sus teléfonos móviles también es una buena solución, que generalmente te permite obtener información más importante..

comment Belle delphine porn says

February 11, 2024 at 3:52 amThank you, I have just been searching for information approximately this topic for a while and yours is the best I have found out so far. However, what in regards to the bottom line? Are you certain concerning the supply?

comment goltogel says

February 14, 2024 at 4:34 amYour kindness shines through your words. Thank you for being a beacon of light.

comment GlucoRelief results says

February 15, 2024 at 1:18 amGreat information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

comment danatodo alternatif says

March 11, 2024 at 2:12 pmYour words of encouragement were just what I needed to hear today. Thank you for your support.

comment danatodo alternatif says

March 11, 2024 at 6:31 pmYour post was a reminder that even on the toughest days, there is still beauty to be found. Thank you.

comment danatodo alternatif says

March 11, 2024 at 11:54 pmYour post made me feel seen and understood in a way that I haven’t felt in a long time. Thank you.

comment danatoto alternatif link! says

March 13, 2024 at 12:13 pmdanatoto alternatif link!

comment danatoto says

March 13, 2024 at 4:25 pmdanatoto alternatif link!

comment dingdongtogel alternatif link! says

March 15, 2024 at 4:34 pmCompletely aligned with the opinions above; this post is a joyous discovery!

comment daftar masuk says

March 24, 2024 at 10:46 pmfantastic morning beginning with an amazing literature 📚🌅