With its bullet trains, love of robots and elaborate talking toilets, Japan has often been an innovator when it comes to technology. Now, Japan is leading the way with new crypto regulations released this week.

Japan’s Financial Service Agency (FSA) has unveiled plans to allow the crypto industry to self-regulate. Notorious for two of the biggest crypto hacks to date, Japan is working to improve the security of the sector.

Leading the way with self-regulation

The FSA released a statement on Wednesday confirming that the crypto industry would be self-regulated, as recommended by the Japanese Virtual Currency Exchange Association (JVCEA)

The JVCEA will now be in charge of developing the guidelines for self-regulation. From handling disputes to holding digital currencies, the JVCEA guidelines will offer greater stability within Japan’s crypto exchanges.

So why does this self-regulation matter? Put simply, Japan’s crypto industry will now have an independent authority for exchanges to consult if problems surface. If exchanges choose to be apart of the JVCEA (which all 16 are), they will also have access to support from Japan’s financial department.

The question still remains if this new association will impact the decentralised nature of the crypto industry. As a body only established in April this year, it seems that only time will tell if the JVCEA’s guidelines will succeed in regulating an industry so difficult to control.

Japan’s Financial Services Agency (FSA) is expanding its crypto team (30 to 42 officials) to keep up with increasing interest towards crypto.

According to Reuters Japan, 160 firms are expected to submit licenses to operate as crypto exchanges in 2019.

This is rapid growth.

— Joseph Young (@iamjosephyoung) September 13, 2018

Recovering from its scam-ridden past

These new regulations begin to make more sense when considering Japan’s scam-laden crypto industry. It was only a matter of time before the country developed these preventative measures.

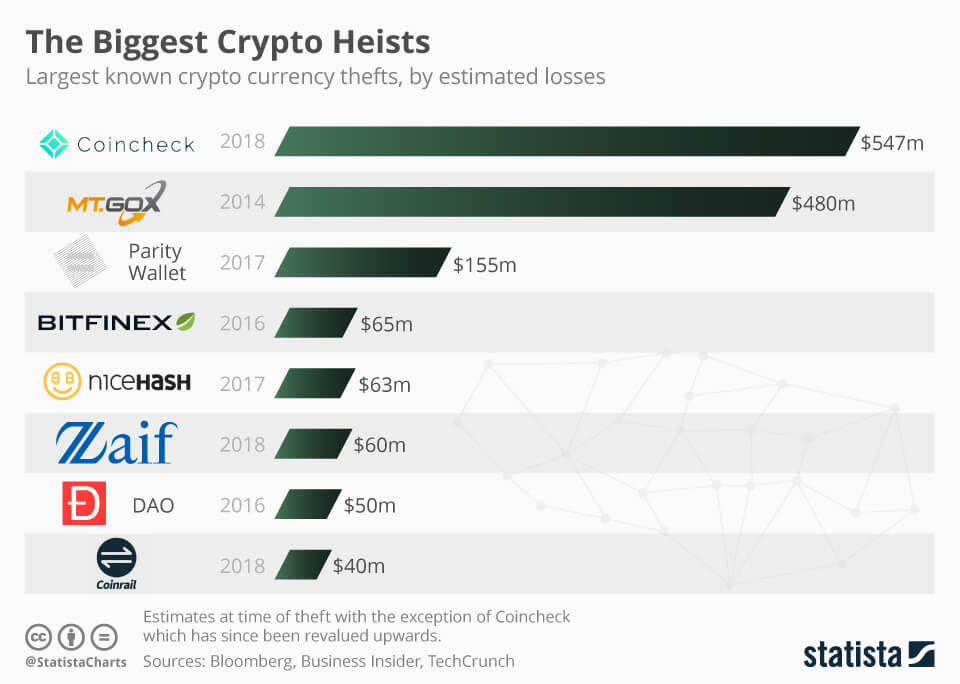

Beginning with the Mt. Gox attack in 2014, Japan’s history of scams is notorious in the crypto community. The most recent scam involved Japanese exchange Coincheck, which saw $530 million worth of NEM tokens stolen in January this year. It was later discovered Coincheck had been storing tokens in online storage known as hot wallets. Secure for small amounts of cryptocurrency, hot wallets are vulnerable when large amounts of currency are stored.

From this scandal, Coincheck remains temporarily closed. An apology still features on their homepage.

We vow to take action on all of the points listed in the business improvement order handed down from the Financial Services Agency as we work towards resuming normal business operations.

Soon after this hack, the FSA suspended exchanges Fsho and Bit Station to stifle further attacks. This, however, could not stop the attack that targeted the Zaif Exchange in September this year.

On the right path

Nearly ten months after the Coincheck heist, these regulations function as a long-term framework to prevent any further attacks. Ultimately, these regulations hope to improve the security for individuals purchasing and selling digital currencies.

And the regulations don’t stop there. Japan’s Ministry of Economy, Trade and Industry have outlined their wider vision for fintech in Japan. It’s an exciting time for technology in Japan, as the report suggests the country “ will develop fully digitalised financial services by promoting open APIs and leveraging blockchain technology”. The Ministry also holds ambitions to better integrate fintech in mainstream society, crypto included.

“The Ministry of Economy, Trade and Industry (METI) is looking beyond the conventional practices of financial service providers, to consider how FinTech can best serve individuals and companies.”

With these regulations and fintech missions in place, Japan has finally secured a win to protect its thriving crypto industry. Its scam-ridden history is hopefully only a memory now, as Japan continues to lead the way in the fintech space.

To keep up with the latest crypto and blockchain news and updates, subscribe to our weekly newsletter.