In what feels like ancient history, money was made of gold. In more recent history, money simply represented gold. With countries increasingly moving off of the gold standard

, how will we measure value? To be clear, this is a trend that predates the rise of cryptocurrencies. We were asking these questions well before crypto came along. However, a new report asks how cryptocurrencies like Bitcoin fit into this question.

How Does Bitcoin Compare to Gold?

Grayscale, a New York-based digital investments firm established in 2013 by the Digital Currency Group, has long believed that crypto, particularly Bitcoin, can change not only how we use money, but how we think about it. Their recent paper explains this philosophy.

Published late last month, the twenty-one-page report, “Bitcoin & the Rise of Digital Gold” begins, essentially with a brief history of money. The early sections focus on why gold was a common currency or currency backer. Those interested in economics will be familiar with the idea of what makes an effective currency: scarcity, verifiability, durability, portability, divisibility, fungibility, and recognisability.

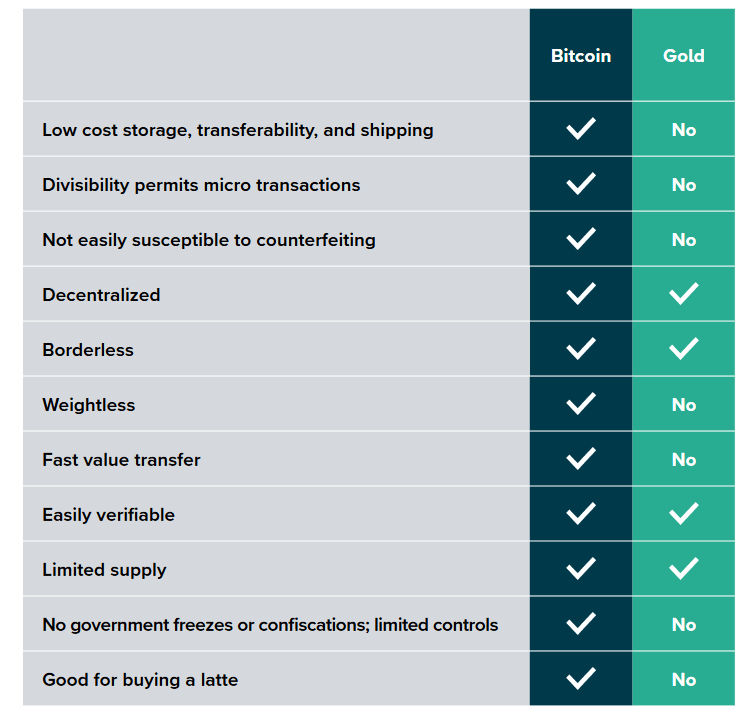

The paper continues to compare Bitcoin to gold as a currency. They find that crypto is more scarce and more easily verifiable than gold. It’s also pretty durable, infinitely portable, almost infinitely divisible, and sufficiently fungible and recognisable. Crypto, the paper concludes, is a better money than gold. Bitcoin possesses a superior composition of ‘good money’ qualities made for a digital global economy,

the paper says.

Is Now a Good Time to Buy Bitcoin?

The paper doesn’t end there, however. It continues to explain why now is a great time to invest in Bitcoin. In addition to all of the benefits we think of when we think of cryptocurrency, even though it’s still early, Bitcoin is growing in popularity. As Bitcoin grows in popularity, it becomes both more valuable and more stable.

The paper also identifies investment as a safe bet because Bitcoin isn’t tied to external factors. Authors assume that people are holding crypto as an investment. Other investments, like stocks, commodities, etc. are tied to specific events or locations. Conflict can disrupt the price of oil. Natural disasters can affect the price of grains. Individuals can impact the value of company stocks. None of these things are true of cryptocurrency. As a result, crypto is actually a comparatively low-risk asset that investors can use to diversify their portfolios.

Analysis

So, what about the paper?

It didn’t really say anything that the crypto community hasn’t heard before. What it did do was pretty effectively take all of the bargaining points into one place with lots of nice graphics. Basically, if you’re already into crypto, it might not be that valuable to you. However, if you have a friend who is interested in or sceptical of crypto, point them in the direction of this paper.

Those who are knowledgeable advocates of crypto may actually have some problems with the paper. For one thing, it doesn’t mention any of the barriers to crypto adoption. Further, it doesn’t really talk about crypto adoption as a currency. While it’s great to talk about crypto as a good investment, most crypto fans are ready to talk about using crypto to actually buy goods and services. The paper mentions that crypto could be an “efficient means of exchange” but that’s about it.

The authors also leave more questions asked than answered about the rise of digital gold

. The paper essentially says that crypto could replace gold in principle but doesn’t offer forecasts or recommendations on that actually happening.

Comments(60)

comment linetogel says

January 18, 2024 at 12:30 pm💫 Wow, blog ini seperti perjalanan kosmik meluncur ke galaksi dari kegembiraan! 💫 Konten yang menarik di sini adalah perjalanan rollercoaster yang mendebarkan bagi imajinasi, memicu ketertarikan setiap saat. 🌟 Baik itu gayahidup, blog ini adalah sumber wawasan yang inspiratif! #KemungkinanTanpaBatas Berangkat ke dalam perjalanan kosmik ini dari imajinasi dan biarkan pemikiran Anda melayang! ✨ Jangan hanya menikmati, alami sensasi ini! #MelampauiBiasa 🚀 akan bersyukur untuk perjalanan menyenangkan ini melalui alam keajaiban yang penuh penemuan! 🚀

comment seks siteleri says

January 20, 2024 at 8:23 amwatch porn video citixx.6RgyWlf6IQQB

comment bahis siteleri sikis says

January 20, 2024 at 8:46 amseks siteleri hyuqgzhqt.T8wWhpdYm8jF

comment bahis porno says

January 20, 2024 at 8:55 amsektor benim zaten amin evladi ewrjghsdfaa.E4G76MGN2odK

comment house porn says

January 20, 2024 at 9:17 amsexx wrtgdfgdfgdqq.BclHrVHerkQh

comment viagra says

January 20, 2024 at 9:37 amfuck google wrtgdfgdfgdqq.63g78fWcIHRF

comment linetogel says

January 21, 2024 at 4:41 am🌟 Incredible, this is truly mind-blowing! Kudos for the work you invested in sharing this priceless data. It’s always wonderful to come across skillfully written and insightful posts like this. Keep up the excellent job! 🔥👏💯

comment linetogel says

January 25, 2024 at 6:48 amAbsolutely thrilled to share my thoughts here! 🌟 This content is refreshingly unique, blending creativity with insight in a way that’s both engaging and enlightening. Every detail seems carefully put together, exhibiting a deep appreciation and passion for the subject. It’s extraordinary to find such a perfect blend of information and entertainment! Kudos to everyone involved in creating this masterpiece. Your hard work and dedication are truly remarkable, and it’s an absolute joy to witness. Looking forward to seeing more of this incredible work in the future! Keep inspiring us all! 🚀👏💫 #Inspired #CreativityAtItsBest

comment bandar slot terpercaya says

January 29, 2024 at 6:13 am💫 Wow, blog ini seperti roket melayang ke alam semesta dari keajaiban! 🌌 Konten yang menegangkan di sini adalah perjalanan rollercoaster yang mendebarkan bagi imajinasi, memicu kagum setiap saat. 💫 Baik itu gayahidup, blog ini adalah sumber wawasan yang inspiratif! #TerpukauPikiran 🚀 ke dalam pengalaman menegangkan ini dari imajinasi dan biarkan pikiran Anda terbang! 🚀 Jangan hanya membaca, alami sensasi ini! #BahanBakarPikiran 🚀 akan bersyukur untuk perjalanan menyenangkan ini melalui dimensi keajaiban yang penuh penemuan! ✨

comment Phone Tracker Free says

January 30, 2024 at 4:34 amIt is very difficult to read other people’s e-mails on the computer without knowing the password. But even though Gmail has high security, people know how to secretly hack into Gmail account. We will share some articles about cracking Gmail, hacking any Gmail account secretly without knowing a word.

comment wonderful says

January 31, 2024 at 7:13 amHoly moly, discovering this blog is akin to finding a hidden gem in a vast digital universe! 🌟 Right from the start I began reading, I was hooked! How you articulate your ideas is absolutely spellbinding, drawing me in with every word. It’s like taking a thrilling journey through a wonderland of knowledge and insight! 🚀💡 Your passion for the subject shines through, igniting a spark of excitement within me. I can’t wait to delve deeper into your other posts and discover more of this enriching content! Keep shining bright and motivating us all! 🌈✨

comment eski rahatiniz olmayacak says

February 2, 2024 at 11:36 ambahis porno pompadirha.eWgKxBIoPZfR

comment food porn says

February 2, 2024 at 11:51 amescort asillartaklitler.9Ve9Zz04spFJ

comment bahis porno says

February 2, 2024 at 4:34 pmam siteleri hephupx.1dB8hU6ED11H

comment seks siteleri says

February 3, 2024 at 12:07 pmfuck hepxhupx.huLkw1Rrv70u

comment sektor benim zaten amin evladi says

February 3, 2024 at 1:02 pmsexax juljulfbi.NvvJm2soNmOR

comment bahis siteleri child porn says

February 5, 2024 at 7:03 amanal sikis siteleri bjluajszz.FT5Cg3BFEhR0

comment amciik siteleri says

February 5, 2024 at 7:21 ameski rahatiniz olmayacak bxjluajsxzz.AnD4SeXgOw9T

comment seksi siteler says

February 5, 2024 at 7:42 ambahis siteleri incest category 0qbxjluaxcxjsxzz.mK5hgiu87s7j

comment Phone Tracker Free says

February 11, 2024 at 12:01 pmYou can also customize monitoring for certain apps, and it will immediately start capturing phone screen snapshots regularly.

comment linetogel says

February 19, 2024 at 9:49 pm🚀 Wow, this blog is like a fantastic adventure launching into the galaxy of endless possibilities! 🌌 The thrilling content here is a captivating for the imagination, sparking excitement at every turn. 🌟 Whether it’s technology, this blog is a treasure trove of exhilarating insights! 🌟 Embark into this cosmic journey of discovery and let your imagination fly! 🌈 Don’t just enjoy, immerse yourself in the thrill! #BeyondTheOrdinary 🚀 will be grateful for this exciting journey through the realms of awe! 🌍

comment escort says

February 21, 2024 at 7:40 ambahis siteleri sikis pokkerx.UJgBsrs8bwuY

comment watch porn video says

February 21, 2024 at 7:53 ampornhub bahis siteleri footballxx.ypznhj6JOqbr

comment eskort siteleri says

February 21, 2024 at 7:57 amporno izle mobileidn.yX16FnijGFCw

comment porno siteleri says

February 21, 2024 at 8:02 amporno izle bingoxx.bU2zx3APQqFj

comment pornhub bahis siteleri says

February 21, 2024 at 8:39 ambahis siteleri porn sex incest 250tldenemebonusuxx.XopVFgHDSAvR

comment seks siteleri says

February 21, 2024 at 10:48 amporno siteleri eyeconartxx.NXQs446HHaI6

comment vorbelutr ioperbir says

February 22, 2024 at 11:09 amI got what you mean , appreciate it for posting.Woh I am happy to find this website through google.

comment am siteleri says

February 22, 2024 at 5:04 pmporno izle vvsetohimalxxvc.5p6Hqj7RknP0

comment escort siteleri says

February 23, 2024 at 8:58 pmanal siteleri tthighereduhryyy.aeFAHfBpD7i

comment ziatogel says

March 2, 2024 at 5:29 amIncredible, you’ve really outdone yourself this time! Your effort and creativity are truly commendable of this piece. I just had to take a moment to express my gratitude for bringing such amazing work with us. You are incredibly talented and dedicated. Keep up the fantastic work! 🌟👏👍

comment ziatogel says

March 2, 2024 at 7:03 amThis is amazing, you’ve truly surpassed expectations this time! Your effort and dedication shine through in every aspect of this piece. I couldn’t help but express my appreciation for bringing such incredible content with us. Your dedication and talent are truly remarkable. Keep up the excellent work! 🌟👏👍

comment hd porno .com says

March 13, 2024 at 3:48 pmsex video download in hd ggjinnysflogg.yj1qohNEAvI

comment vorbelutr ioperbir says

March 20, 2024 at 6:07 amPretty! This was a really wonderful post. Thank you for your provided information.

comment vorbelutrioperbir says

March 20, 2024 at 6:22 amYou can definitely see your skills in the work you write. The world hopes for more passionate writers like you who aren’t afraid to say how they believe. Always follow your heart.

comment redirected here says

March 22, 2024 at 4:44 amNice read, I just passed this onto a colleague who was doing some research on that. And he just bought me lunch since I found it for him smile So let me rephrase that: Thanks for lunch!

comment look at these guys says

March 22, 2024 at 4:48 amGood day! This post could not be written any better! Reading through this post reminds me of my good old room mate! He always kept chatting about this. I will forward this page to him. Pretty sure he will have a good read. Thanks for sharing!

comment this website says

March 22, 2024 at 5:13 amso much fantastic info on here, : D.

comment over here says

March 22, 2024 at 5:15 amThanks for this post, I am a big fan of this site would like to proceed updated.

comment Buy nicotine pouches says

March 23, 2024 at 4:26 pmMy brother recommended I might like this website. He was totally right. This post actually made my day. You cann’t imagine just how much time I had spent for this information! Thanks!

comment Buy nicotine pouches says

March 23, 2024 at 4:34 pmNice blog here! Also your website loads up very fast! What web host are you using? Can I get your affiliate link to your host? I wish my web site loaded up as fast as yours lol

comment Buy nicotine pouches says

March 23, 2024 at 4:51 pmI’ve been exploring for a little for any high quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this site. Reading this information So i’m happy to convey that I’ve an incredibly good uncanny feeling I discovered just what I needed. I most certainly will make sure to don’t forget this site and give it a look regularly.

comment Buy nicotine pouches says

March 23, 2024 at 4:56 pmYou are my inspiration, I have few blogs and often run out from brand :). “Never mistake motion for action.” by Ernest Hemingway.

comment home care services says

March 24, 2024 at 8:44 pmI was recommended this web site by my cousin. I am no longer certain whether or not this submit is written via him as no one else recognise such specific approximately my trouble. You are wonderful! Thank you!

comment personal assistants says

March 24, 2024 at 8:46 pmThis blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen

comment personal assistants says

March 24, 2024 at 9:11 pmI am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

comment personal assistants says

March 24, 2024 at 9:13 pmYoure so cool! I dont suppose Ive learn something like this before. So good to seek out anyone with some original ideas on this subject. realy thanks for beginning this up. this web site is one thing that is wanted on the net, somebody with just a little originality. useful job for bringing something new to the web!

comment melhor código de indicac~ao binance says

March 26, 2024 at 9:45 amThank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

comment toroidal transformers says

March 26, 2024 at 4:55 pmIt¦s in reality a great and helpful piece of info. I am satisfied that you simply shared this helpful information with us. Please stay us informed like this. Thank you for sharing.

comment toroidal transformers says

March 26, 2024 at 4:58 pmhey there and thanks in your info – I have certainly picked up anything new from right here. I did then again experience several technical issues the usage of this web site, since I skilled to reload the site a lot of times previous to I may just get it to load properly. I had been thinking about if your web hosting is OK? Now not that I am complaining, however sluggish loading circumstances times will sometimes have an effect on your placement in google and could injury your high quality rating if advertising and ***********|advertising|advertising|advertising and *********** with Adwords. Well I’m including this RSS to my e-mail and can glance out for much extra of your respective fascinating content. Make sure you update this again very soon..

comment alternatif link says

March 26, 2024 at 5:07 pmAmidst the hustle and bustle of life, your post reminds me to pause and appreciate the beauty of today.

comment toroidal transformers says

March 26, 2024 at 5:22 pmWow that was unusual. I just wrote an incredibly long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say fantastic blog!

comment toroidal transformers says

March 26, 2024 at 5:24 pmGreetings! Quick question that’s totally off topic. Do you know how to make your site mobile friendly? My blog looks weird when browsing from my iphone 4. I’m trying to find a template or plugin that might be able to correct this issue. If you have any suggestions, please share. With thanks!

comment slot games says

March 26, 2024 at 5:26 pmAmidst the hustle and bustle of life, your post is a moment of quiet reflection. Thank you for brightening my day.

comment alternatif link says

March 26, 2024 at 8:53 pmnice content!nice history!! boba 😀

comment daftar masuk says

March 26, 2024 at 9:42 pmnice content!nice history!! boba 😀

comment 100 TERPERCAYA says

March 26, 2024 at 11:47 pmwow, amazing

comment alternatif link says

March 27, 2024 at 12:27 amnice content!nice history!! boba 😀

comment daftar masuk says

March 27, 2024 at 3:28 amnice content!nice history!! boba 😀

comment fashionflag download porn videos 4k says

March 27, 2024 at 8:27 amfashionflag full hd sex video 4k fashionflag.aniGGeTRmX4